These institutions typically consider a broader choice of qualification aspects, together with choice monetary information readily available by means of Clarity Providers.

Nonetheless, this sort of financing relies on your individual credit and cash flow, Placing your personal credit and property in danger.

Kiah Treece is a small company operator and private finance pro with working experience in loans, business and private finance, insurance plan and real estate property.

Bankrate.com is undoubtedly an unbiased, marketing-supported publisher and comparison assistance. We are compensated in exchange for placement of sponsored services and products, or by you clicking on selected links posted on our web page. For that reason, this compensation may well effect how, where and in what purchase solutions seem in listing types, besides where by prohibited by regulation for our mortgage, dwelling equity along with other dwelling lending solutions.

The objective of a credit-builder loan would be to do exactly that: Construct your credit. To obtain the economic energy that a superb credit rating brings, you must protected a loan you are able to afford to pay for and pay back punctually. When procuring, pay close focus towards your monthly payment and unique demands.

Business time period loans supply a lump sum of money upfront, paid out with curiosity in fixed weekly or regular monthly installments.

Aside from property finance loan loan gives, this compensation is one of various elements that may impression how and in which offers look on Credit Karma (which include, for example, the purchase through which they appear).

Lightbulb Bankrate tip Take advantage of a personal loan calculator to be certain that you will be able to continue the payments.

When approved by a lender, your money are deposited right into your account once the subsequent enterprise working day.

Invoice factoring enables companies to sell unpaid invoices to a factoring organization in exchange for any money advance.

This implies you may get a estimate from your financial institution and from a number of on line lenders to match curiosity premiums and find out if sticking with the financial institution is the best option.

How Does LendingTree Get Paid? LendingTree is compensated by organizations on This web site which compensation may possibly impression how and where offers appear on small credit loans This website (such as the order). LendingTree doesn't contain all lenders, discounts products and solutions, or loan solutions out there during the Market.

Microloans are sometimes geared towards startups or underrepresented entrepreneurs, like Gals or people today of color.

Generally, your company are going to be inside a more robust situation to borrow if you can confirm you've got a background of good revenue over the past one to two a long time. This is more interesting into a lender than a business with spotty income over the past six months.

Jennifer Grey Then & Now!

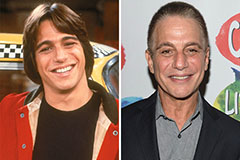

Jennifer Grey Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now!